Hello. My name is Felix Chavez. I’m the owner of the Chavez Insurance Group in Round Rock, Texas. I have been a life insurance agent for 21 years, and in researching during different times of the year, one of the particular times that I love to be able to see information on life insurance is during September. September is Life Awareness Month, where a lot of companies will make life insurance a priority. And in looking at LIMRA, which is a website that is a research tank for a lot of insurance agents and insurance companies, they posted information as to why people don’t buy life insurance. And one of the reasons is that prospects are unsure of how much coverage to buy and what type.

And the type is important. Most people are not aware that today you can purchase life insurance, while living you can use the benefits. So they’re called living benefits available in life insurance policies. Now, most companies still don’t offer all of them, and if they offer them, they charge you for them. Well, National Life Group has four living benefits built into their policies and they come with each one of the policies, whether you’re buying a term, a whole life, or universal or index universal life policies.

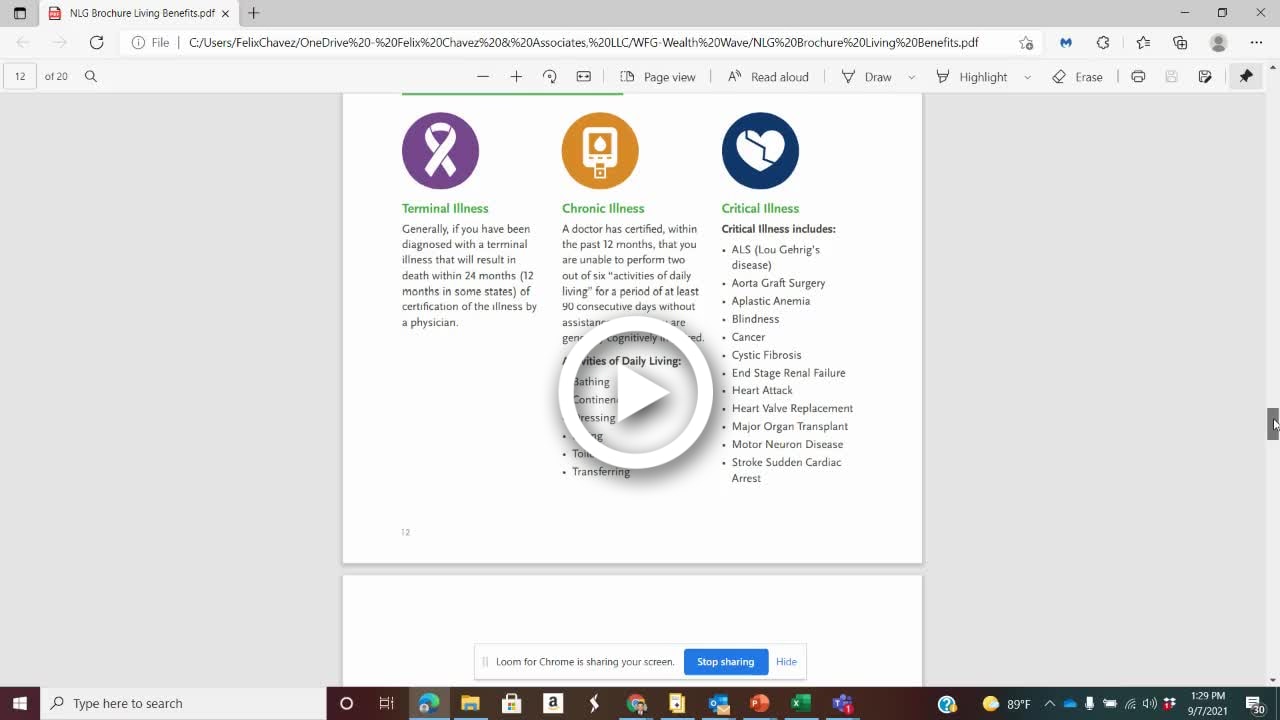

The coverages and the benefits work in this fashion. There’s four of them, terminal illness, chronic illness, critical illness, and of course the last one being the critical injury. So I’ll give you a very simple explanation. If I was a patient that had a terminal illness and had a 24-month time period to live, I would be able to take up to 100% of that death benefit to be able to use while I’m still living, so I don’t have to die to be able to use that coverage. And if I had a half a million dollar life policy, well I could definitely do a whole lot with that half a million dollars to take care of myself and to pay expenses while I was still living.

So again, living benefits can be a huge, huge impact on families, especially when they have issues that they’re going to survive. And most people can survive a lot of these listings on this page and it becomes expensive for them to continue paying medical bills. So the living benefits were introduced by National Life Group many years ago, and in 2007 were introduced inside of the policies already built in. So if you need some help understanding your life policy or you need to compare your life policy to a company that has living benefits, please give us a call, 512-989-0668.

Call Chavez Insurance Group in Round Rock TX at (512) 989-0668